I launched this newsletter a year ago. In 2023, I was testing the waters. Starting this January, it will slightly change – but you’ll learn more about it at the end of the article.

So, goodbye, strategic planning.

Running a business using a classical strategic approach is like building a house with just the blueprint for the basement.

If you can’t solve a task, two reasons might explain it:

You’ve chosen the wrong tool

You’re not skilled for the job

And the first one is more crucial. You can’t hammer a nail with a sofa cushion, even if you’re a seasoned carpenter.

Fifteen years ago, I used the classical playbook. I enthusiastically set goals, crafted strategies, and created long-term projects. They looked picture-perfect but were non-functional.

Did I pick a cushion instead of a hammer, or did I lack mastery?

Business magazines convince us that strategy is great. And if we fail, we misuse it.

I don’t think so.

No wonder they sing the praises of business strategy. The global strategy consulting market was valued at $38.4 billion in 2021 and is projected to reach $111.4 billion by 2031. It’s a big pie, and they want a piece.

I was surprised to read it in the HBR Magazine, the mouthpiece of the academics and big consultants, but they indeed said it: “Strategy feels complex because academics, consultants, and other experts benefit from the perception it is complex.”

But complexity isn’t the main problem.

After 20 years of practice, I am sure the classical strategy method misses some critical points.

Starting with this article, I will share a different concept with you. I’ve been developing it for over 15 years as a CEO, a board member, and a strategy consultant.

I don’t deny business strategy as a concept. But I will offer you to look at it from a different angle.

Eight Isn’t Great

Bold goals destroy companies more often than you think.

In 2011, the Wells Fargo bank developed a new strategy. The CEO, John Stumpf, called it “Eight Is Great.” At the time, most customers used only one or two bank products. The top executives firmly decided to increase this number to eight.

But workers struggled to meet demanding quotas. They began to cut corners and opened 1.5 million unauthorized deposit accounts and made 500.000 unauthorized credit card applications for Wells customers – without their knowledge.

In 2011, the bank earned $2.6 million in fees. In 2016, it paid $185 million in fines.

It could be just a story about how executives misuse KPIs. But for me, it is a great example of the disruption of the Value balance.

Value balance

In business, as in life, you don’t get what you deserve, you get what you negotiate (Chester L. Karrass).

We all have needs. But we can’t simply get what we want. We must exchange it for something.

Humans began to play the game of exchange thousands of years ago. Hunters traded hides (values they had) for pots and weapons (values they needed). Ancient people united to hunt mammoths. They formed alliances for power and plotted conspiracies.

We exchange emotions, influence, material and immaterial values. Those more deft in exchange tip the value balance in their favor. They gain more than they give. We call them “successful”. The less skilled complain about the unfairness of life and vent on social media.

We all trade the values we can give for the values we want to get. Our well-being depends on the balance between the value given and the value received.

The same is true in business.

Business and value balance

“He who would buy sausage of a dog must give him bacon in exchange”

Old Danish proverb

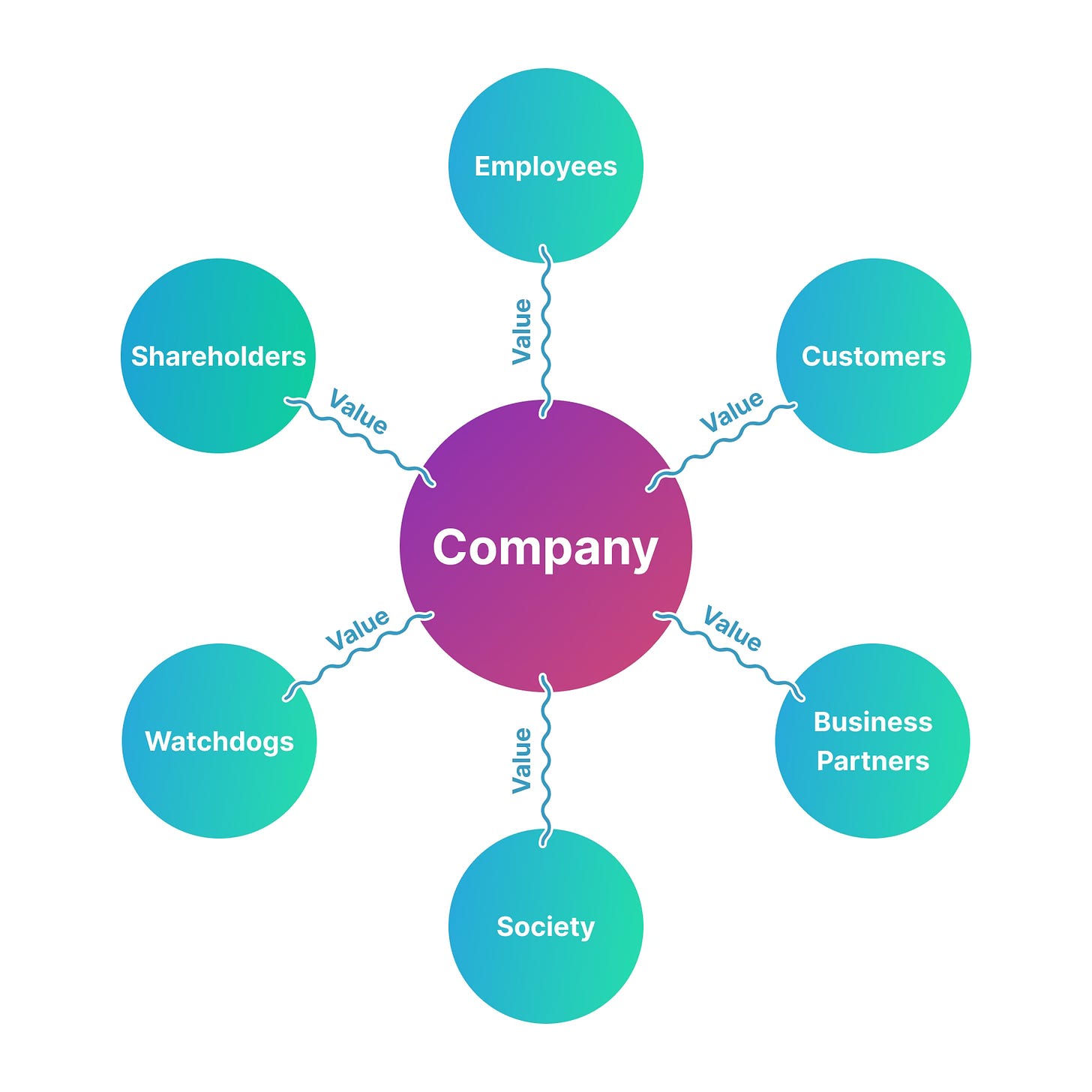

Every company, whether it is small or giant, must deliver value for six groups of stakeholders:

Customers

Employees

Shareholders

Business partners

Regulators or watchdogs

Society

And the major task of company leaders is to strike a balance between stakeholders’ interests, no matter how contradictory they may be.

Wells Fargo’s executives put the shareholders’ interests above those of customers and employees – and failed.

Every business rests on these six’ legs.’ Remove any of them, and it’ll collapse.

Every passionate leader falls into the same trap by setting ambitious goals like ‘becoming the industry leader’ for their team.

It’s great to see your face on the Forbes cover. But what about other stakeholders?

Value waves

Most corporate documents give no more insight into a company than a train schedule does about the cities the trains are heading to.

A P&L statement or an org chart tells us little about how a company works. It doesn’t tell us how it creates value for its stakeholders.

But creating value is the essence of any business.

Workers perform processes generating the streams of value. I call them Value Waves because every company not only produces various types of value for stakeholders but also receives value in return from them.

And management is all about directing and balancing these Value Waves. If all the stakeholders believe they receive what they deserve in exchange for what they give, the business thrives.

Strategy involves managing these Value Waves in ever-changing conditions and guiding a business toward its objectives.

Running a business using a classical strategic approach is like building a house with just the blueprint for the basement. A classical strategy serves only the interests of shareholders.

But if you put shareholders on a pedestal, the other stakeholders become a crowd at its base. And that’s the biggest mistake you can make.

Pro Tips

Discuss the following questions with your team:

Who are your key stakeholders in each of the six groups?

What are their needs?

What values does your business deliver to them?

What values do you want to receive from them?

What metrics can you use to measure their satisfaction?

Who in your company is personally responsible for the satisfaction of each stakeholder group?

In the upcoming newsletters, we will continue discussing Value Waves and Value Ecosystem Management. Don’t forget to subscribe!

Like the story? Share it on social media.

I will tell you about Value Ecosystem Management in this newsletter piece by piece. But you won’t need to read all the articles in sequence.

I will be revisiting key principles in new articles and using links to the older articles to make it easier for you to understand.

I will combine some articles into mini-books, and you’ll be able to download them.

And I’ll do my best to make them exciting, with many examples, stories, case studies and pro tips.

Stay tuned!

Really enjoyed this take on business strategy.

Super good piece. Love it & looking forward to the next ones!