The Market You Think You’re in Probably Doesn’t Exist

5 Market Strategy Mistakes I Made as a CEO — and How I Help Others Avoid Them. Part 1

As we continue this series on strategic thinking, your thoughtful responses inspired me to tackle these mistakes. That’s how this five-part sub-series was born. Each post stands on its own—you don’t need to read them in order.

**

Measuring market size in dollars is like measuring emotions with a thermometer.

In 1980, AT&T asked McKinsey to estimate how many cell phones would be in use worldwide by 2000.

McKinsey noted all the problems:

the handsets were the size of a brick and just as heavy

the batteries kept running out

the coverage was patchy

the price per minute was sky-high

So, the firm concluded that the total market would be about 900,000. In monetary terms, the future market seemed tiny for a giant like AT&T.

Making market predictions is a risky business. Even large, reputable institutions make completely off-the-mark mistakes.

But that’s just part of the problem. We make five critical missteps when assessing the market for strategic purposes.

Today we'll focus on the first pitfall – the market you think you’re in probably doesn’t exist.

The Big Marketing Lie

You read something in the newspaper like: “The car market grew by 15% in 2024 compared to 2023.”

This line has nothing to do with the car market, marketing, or strategy. It simply states that more cars were sold in 2024 than in 2023 — and nothing else.

It doesn’t actually indicate that the car market is growing, because ‘market’ isn’t the number of products sold.

Economists do it that way because it’s easier. But have you ever heard of a Fortune 500 company founded by an economist? Entrepreneurs do it another way.

Look at two examples:

Example 1

Imagine that in 2024, X square meters (or feet) of housing were sold in your country for a total of Y dollars. An economist would say, “The housing market in 2024 was X square meters (or feet), or Y dollars.”

But let’s say that twice more people wanted to buy housing in 2024 but couldn’t afford that. If you find a way to cut building costs or created a financial model that helps people who can’t afford housing buy it, the market size doubles overnight!

Example 2

Imagine you sell electric drills. If you measure your market only by units sold, you miss those who rent them, borrow them from a friend, or hire someone online to do the job.

A strategist would measure the market by how many holes get drilled per year.

If your CMO defines your market by units sold, it might be time to update your hiring standards.

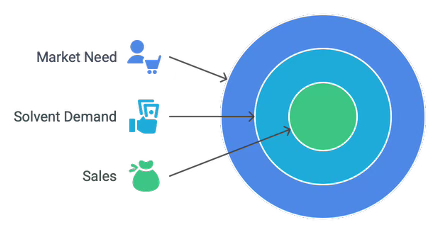

For strategic purposes, a market is defined by the volume of need — both conscious and latent — not by the volume of products sold.

Conscious, solvent need is called “demand.”

Solvent demand is usually lower than sales, since some people don’t end up buying — for all kinds of reasons.

Sometimes in my strategy lectures, I use a playful metaphor:

The volume of need is the number of teenagers dreaming of becoming superheroes

Solvent demand is the number of people reading superhero comics

Sales are those who actually bought a gym membership

Making strategic decisions based only on sales numbers is reckless. For instance, in 2006, only 64 million smartphones were sold worldwide. That was just a small fraction of the 1+ billion mobile phones sold overall.

If Steve Jobs had been an economist, Apple would’ve just kept making computers and never unveiled the iPhone in January 2007 — the smartphone “market” seemed too small and unattractive.

The Volume of Need

When I work with clients on their strategies, I use a market formula by Philip Kotler:

Market = Need (or utility) + Target consumers + Place of purchase + Time of purchase + Situation of purchase + Customer experience

For example, if you (the target consumer) buy a smartphone as a birthday gift for your partner (situation) in a mall (place) on a Friday evening (time), and you feel excited about it (experience), you're satisfying your need to show how much you love them.

Every market has a unique set of these characteristics, but the first one – need – is most important.

Measuring it is harder than it seems. There are different approaches to the task.

For instance, when I help investment funds evaluate startups pitching their projects, the startups often use the similar term TAM — Total Addressable Market.

The TAM is the total revenue opportunity for a product if it captures 100% of the potential market. TAM is a term that’s close to “the volume of need,” but its simplicity is deceptive.

Let’s say you’re building an AI agent to assist with MS Word. Some 1.2 billion people use MS Word. If you sell your solution for $50, it may seem that your TAM = 1.2*$50 = $60 billion.

Nothing could be more wrong. Thinking this way is like believing that if you sell men's shirts, your TAM includes all the men on the planet.

The number of Word users who has specific problems your solution solves shapes your TAM, or the volume of the market need.

You might argue that your AI agent helps people type faster — who wouldn’t want that? But many MS Word users don’t need to type faster and aren’t willing to pay for that.

You might argue that as soon as these people see your beautiful, user-friendly solution at play, they’ll love it — and you’d be wrong again.

Willingness to buy tech gadgets — even useful ones — is overrated. Just remember: over 5% of organizations in the U.S. are still using typewriters.

If you think your market includes all MS Word users, you're overly optimistic.

But if you believe it includes only those who are eager to type faster and willing to pay $50 for the solution, you're overly pessimistic.

To get a clearer picture of how big the volume of need is in your market — for strategy purposes — you’ve got some serious work to do. You need to dive deep into your customers’ needs and pains, figure out how urgent their problems really are, and learn everything about how they’re solving them today. That means running both quantitative and qualitative research.

Talk to 20-50 customers depending on your market size, conduct a few focus groups, hypothesise, and test the hypotheses with surveys.

Only then can you get a better estimate of your potential market size.

Sure, you could skip all that and just launch your product. But don’t forget — the creators of Google Glass, Segway, Juicero, and WeWork skipped this step and were way too optimistic about their TAMs. And you know how those stories ended.

If you need any help with evaluating the volume of need on your market – send me a message.

Conclusion

Estimating market size is useful both when entering new markets and when growing in the ones you’re already in. If you only look at product or service sales, you’re seeing just a small piece of the puzzle.

On the other hand, digging deep into customer needs will give you tons of insights for future products, business models, and strategic moves.

Never miss a chance to talk to your potential customers.

If you’re tired of abstract frameworks and want to actually make progress, these three focused strategy calls might be just what you need.

A present for you

A year ago, I published my book Red and Yellow Strategies: Flip Your Strategic Thinking and Overcome Short-termism. To celebrate the anniversary, I’m offering a special price — all through June.

🎧 Get the audiobook at a special price here.

📘 Get the ebook at a special price here.

⭐️ Upgrade to a paid subscription and get the book for free — plus full access to the archive, all podcast episodes of the book, and every members-only post on Substack.

And of course, you can still grab the book at full price in your favorite bookstore.

––

Read also: Good CEOs See the Distant Future. Great Ones Master the Near Term

Visit my website.

I don't think I can agree to the concentric circles. It's too simplistic. There are many things I bought that I didn't need. My PlayStation 5 is hardly used, for example. It was an impulsive purchase. I could just as well have spent that money on a drone or a home cinema. Does that mean the PlayStation, the drone, and the home cinema compete in the leisure or entertainment market? How do measure that size?

Solid thinking. For strategic making forward-looking environments your referencing, transformative strategic decisions, understanding the "volume of need" is far superior because it's about the opportunity space rather than just the current transaction space. Well said.