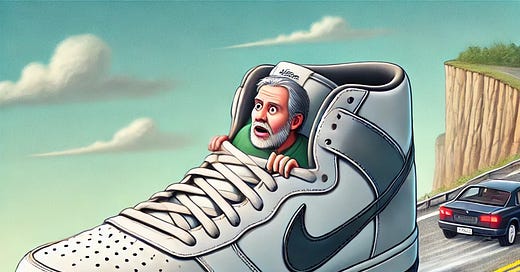

Once Trusted, Then Ousted: Customers Have Fired Nike's CEO

What strategic lessons can we learn from John Donahoe’s dismissal?

You don't need a strategy. You need to see the world strategically. Welcome to the newsletter for deep thinkers.

You can listen to the audio version of the article or read the text below.